Hopper raises $96M from Capital One to focus on social commerce

Investors remain optimistic about tourism despite the slump. Hopper, a travel booking business, raised $740 million today after Capital One invested $96 million. In a press release, CEO and co-founder Frederic Lalonde stated the funds would assist Hopper’s new social commerce projects.

Hopper will work with Capital One, which led its Series F, to develop new travel packages for Capital One consumers as part of the fundraising. Hopper enables Capital One Travel and Premier Collection, the Venture X cardholders-only hotel and resort marketplace. Expect more like that.

Capital One managing VP Matt Knise stated, “With Hopper, we have discovered a partner who can not only match that speed but help us continue to disrupt the existing quo and take a differentiated approach to establish a world-class travel brand. “Through this strategic alliance, we’re well-positioned to react to a fast-evolving travel environment and provide industry-leading solutions for our customers’ travel journey.”

Hopper, founded in 2007 by Frederic Lalonde and Joost Ouwerkerk, spent six years in stealth constructing the “world’s largest organized database of travel information” by trawling blogs, photo-sharing sites, and other sources of information about locations and geolocating them. After Hopper’s 2014 public debut, the company’s leadership shifted to mobile and focus engineering resources on travel prediction, producing a platform that continuously analyzes airline fares and provides push notification price change alerts.

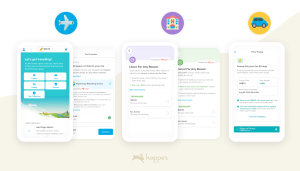

Since then, Hopper has become one of the most excellent travel apps in North America, with over 80 million downloads and sales of flights, hotels, residences, and rental cars expected to exceed $4.5 billion this year. Hopper’s airfare price freezes, “cancel for any reason,” and flight interruption guarantees set it apart from competitors like Travelocity. The former accounts for 40% of the company’s app income.

Hopper Cloud, launched last year, let’s travel providers like Kayak, Marriott, and Trip.com resell Hopper’s finance and travel agency products through a white-label interface. Hopper says Cloud currently accounts for more than 40% of its revenue, and Lalonde says Hopper Cloud is on course to produce more in 2022 than Hopper did last year.

Hopper focused on in-app promotions, discounts, and sales events this spring for consumers. Social commerce—anchored on referrals, share-to-earn, team buying, and daily gifts—is the company’s next big push.

Hopper president Dakota Smith told TechCrunch that international customers made up less than 3% of purchases last year but now makeup over 20%. “The app internationalizes quickly.”

TechCrunch claimed in early February that Hopper was valued at $5 billion; a source believes it has since climbed. The 1,500-employee company, which controls 11.2% of the U.S. third-party air travel industry, seeks to go public.

Sponsored Links